Mapped: Latest house prices in your area after new data reveals average cost

House prices across the country have flattened out month-on-month in June following a small dip in May, an index has shown.

Halifax recorded a zero per cent month-on-month change in average UK property values in June, following a 0.3 per cent fall in May.

The bank said the housing market’s resilience “continues to stand out” following stamp duty changes that came into force from April when discounts on the charge became less generous for some home buyers.

Amanda Bryden, head of mortgages at Halifax, said the UK housing market “remained steady in June”, with average house prices largely unchanged after a slight 0.3 per cent fall in May.

At £296,665, the average property price is still about 2.5 per cent higher than it was a year ago, she said.

“The market’s resilience continues to stand out,” Ms Bryden said, noting that mortgage approvals and property transactions had picked up again after a short dip in the wake of spring stamp duty changes.

She said this was being driven by a few key factors, including rising wages easing affordability pressures and greater confidence among buyers as interest rates stabilise.

“Lenders have also responded to new regulatory guidance by taking a more flexible approach to affordability assessments,” she added.

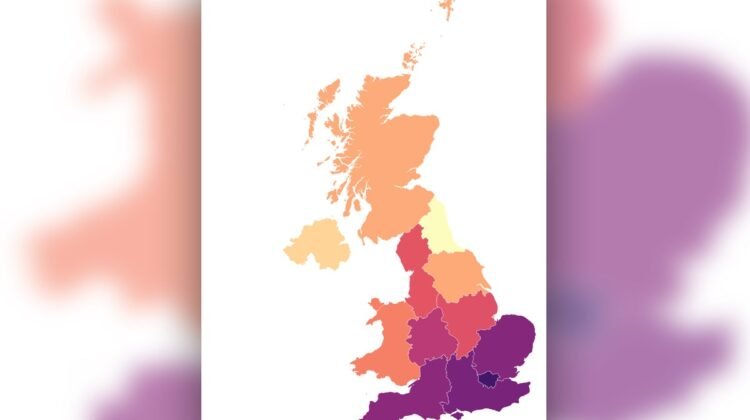

The map below shows the average house price across the UK in June:

Ms Bryden added: “With markets pricing in two more rate cuts from the Bank of England by year end, and the average rate on newly drawn mortgages now at its lowest since 2023, we continue to expect modest house price growth in the second half of the year.”

Sarah Coles, head of personal finance at Hargreaves Lansdown, said soaring house prices are “pushing affordability to the limit”.

While mortgage rates have come down, she noted they “remain much higher than we have been used to in the previous few years” and are not falling particularly quickly.

This is one reason why property sales are holding up better in parts of the country where house prices are typically lower, she said.

“Lenders have reacted to higher house prices by offering more flexibility over how much people can borrow,” Ms Coles added.

She said that for first-time buyers: “It’s worth considering whether you can get any help building your deposit, whether that’s through family and friends or the 25% boost from the Government through the Lifetime Isa.”

Another recent report from Nationwide Building Society indicated that the average house price dipped by 0.8% month-on-month in June.

Tom Bill, head of UK residential research at Knight Frank said: “House prices may have held steady, but high supply and weak demand suggest this is not the start of a rebound.”

He added: “Supply is higher following the stamp duty cliff-edge in March and as more landlords sell, but consumer confidence remains weak after economic activity was pulled forward into the first quarter of the year.

“We expect modest single-digit house price growth in 2025 as rates come down in the second half of the year but asking prices need to reflect the fact it is very much a buyer’s market.”