Why You Might Need to File a Tax Extension This Year

A few years ago, I was running two small businesses, including one as a self-employed freelance writer. When tax season rolled around, I had trouble tracking my quarterly estimated taxes, organizing 1099s and figuring out which business expenses were deductible.

After talking to my tax person, I decided I couldn’t make the standard April 15 deadline and would have to request an extension. Fortunately, that year, the state of California offered an automatic tax extension to all residents to Nov. 16.

This story is part of Taxes 2025CNET’s coverage of the best tax software, tax tips and everything else you need to file your return and track your refund.

While that extra time allowed me to compile everything I needed to hand off to my tax professional, I actually wish I had filed on time. For one, I could’ve used the large tax refund the IRS owed me to put toward my financial goals in the summer. Plus, filing late set me back on prepping for the following tax season.

Depending on your situation, you may want to file a tax extension this year when tax season starts later this month. Here’s what to know if you need more time to submit your return.

Why should you file an extension?

Since I hadn’t kept up with all my financial information and records, I didn’t feel confident that I would have enough time to double-check everything and compile it for my accountant on time.

Whether you’re waiting on records or paperwork or dealing with a family emergency or natural disaster, millions of US taxpayers file late because they have difficulty completing paperwork in time for the April deadline.

Whatever your reason, filing an extension gives you an additional six months to submit your returns. You’ll have to file your returns before the Oct. 15 deadline or else you’ll get hit with a late penalty. However, you still have to pay any tax you owe by the spring filing date (more on that below).

Can you also extend the payment deadline?

If you know that you’ll be getting a refund when you file your return, there’s no penalty for filing your return late. However, if you know you’ll owe the IRS money, you’ll have to make the tax payment deadline. Though it seems backward to pay any tax you owe before filing your actual return, it’s all about estimating.

For example, if you’re using tax software like TurboTax, just input the information you have and make your best guess for anything you’re missing. You can then get an estimate of what you might owe the IRS, even without submitting your return.

If you’re just waiting on just one piece of information, like business expenses, Janet Berry-Johnson, a certified public accountant and founder of Firefly Financial Organizingrecommends using last year’s numbers.

If you have no major changes from last year’s tax return, you’ll want to make sure you want to pay at least what you owed last year, says Tai Stewart, an EA and founder of Support Financial Solutions.

If you don’t pay what you owe on your taxes when you request an extension, you might get hit with an underpayment penalty. To avoid this penalty, you’ll need to pay at least 90% of what you owe this year or 100% of what you paid the year prior, whichever is less.

Why is it better to file by the spring deadline?

There are many reasons to file your taxes by the April deadline. For instance, you’ll need to have your completed tax return on hand to get approved for a mortgage, apply for funding for your small business or complete your FAFSA for federal student financial aid, says Stewart.

Filing earlier in the year can also help you ward off identity theft, according to Berry-Johnson. Identity thieves can get a hold of your name and Social Security number and file a return to claim a refund before you do. If that happens, your tax return could be rejected when you file it.

“At that point, you have to paper file your return and send it in with this tax form and a copy of your photo ID, which can take the IRS months to process,” says Berry-Johnson.

If you become a victim of tax fraud or identity theft, reclaiming your tax refund can take up to two years, adding to the headache and hassle.

What if you can’t afford to pay your taxes on time?

Because I owed the IRS money for one of my business endeavors, I decided to request an installment plan, which was a fairly simple process.

Berry-Johnson says that if you’re not able to pay all your taxes owed by the deadline, pay whatever you can afford to. Don’t avoid filing your return just because you can’t cover the payment in full. You never want to be hit with penalty fees and interest charges.

“If you owe $500 and only have $100, pay the $100,” she says. Though a lot of taxpayers are scared to work with the agency, the IRS is used to working with people’s situations. Here are a couple of payment options through the IRS:

Payment plan: You can set up a payment plan through the IRS website or by calling the IRS and setting it up over the phone. There are no setup fees, but you must pay taxes owed within 180 days.

Installment agreement: Another option is an installment agreement (also called a long-term payment plan), where the IRS will drop your failure-to-pay penalty in half. There might be a setup fee, but the IRS could drop it entirely if you earn a lower income. You have up to 72 months to make monthly payments to pay off your balance.

What are the penalties for not filing your taxes?

Not filing your tax return on time (or failing to file an extension) will cost you 5% of your unpaid taxes for each month. There’s a cap of 25% of your unpaid taxes.

In addition, there’s the failure to pay penalty, which is 0.5% of the unpaid amount for each month you haven’t paid what you owe to the IRS.

If you owe both a failure to file and a failure to pay a penalty, the maximum you’ll owe is 25%. Plus, there’s interest charged, and the interest rate changes every quarter.

You can avoid penalties and interest by paying your debts by the due date or requesting a payment plan.

How do you file an extension?

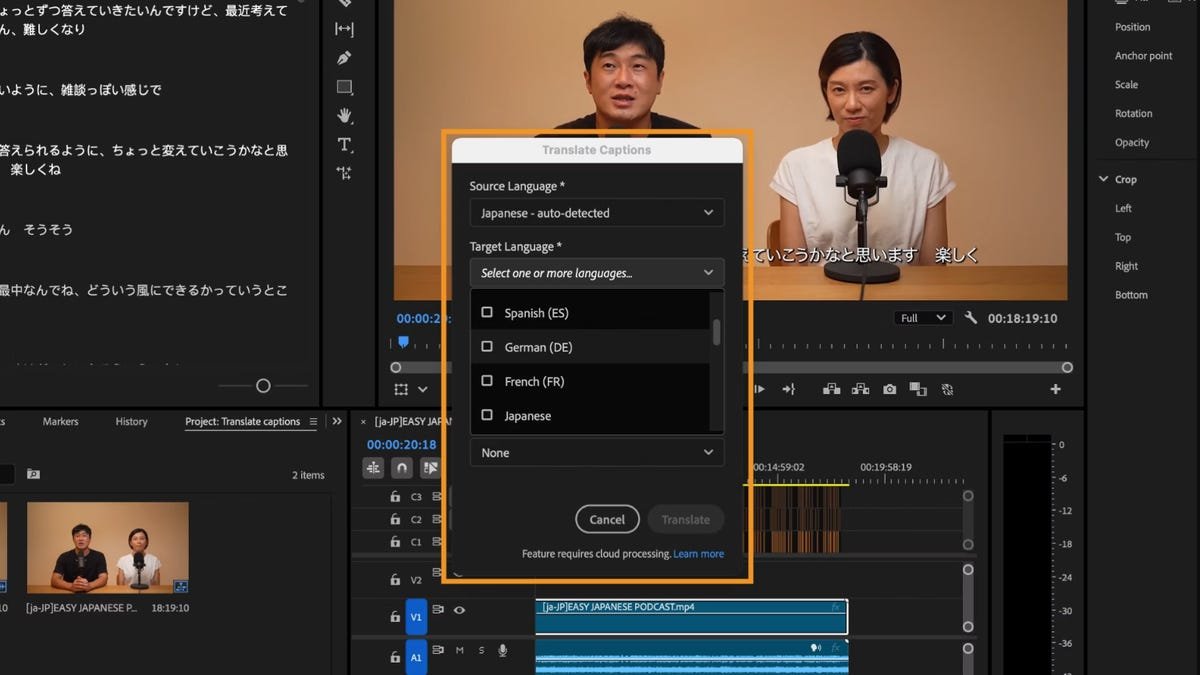

Filing an extension is a straightforward process. You can either make a request online at IRS.gov or mail in a coupon at the bottom of the 4868 Tax Form. You’ll need to include your name, address, Social Security number and how much you’ll be paying with your extension. If you use tax prep and filing software, you can also request an extension through the software.

When you file an extension, some states will automatically extend your state return as well, says Berry-Johnson. However, some states require you to file a separate extension.

How can you file your taxes on time?

In the last few years, I’ve made a point to stay on top of my accounting. I reconcile the transactions in my QuickBooks Online account on a regular basis. I also complete any required tasks through Gusto, my payroll service.

While I do slip from time to time (life happens), I work with a bookkeeper who helps me settle any discrepancies and makes sure everything is ready by tax season. Tax pros tend to get busy and less available starting in December, so try to touch base with them beforehand.

“If you’re working with a tax professional like a CPA or EA [federal tax practitioner or enrolled agent] to help you file your taxes, stay in communication with them and check when you need to submit the required documents and information,” says Stewart.

Here are some pointers on how to file your taxes on time for the next tax season:

- Create a tax file at the beginning of the year, a designated spot to keep your tax-related forms and documents together, whether they’re digital or paper.

- For small business owners, make sure your books are up to date.

- Gather what you can and input your best guess for anything you’re missing. Once you have all the information you need, you can go ahead and file.